The Polish retail market has reached saturation point according to real estate giants CBRE and JLL. According to a report published by CBRE Poland, the Polish commercial...

Analysis

With European elections in May, and a general election in the autumn, 2019 is set to be a crucial year for Poland. For the ruling party, it has not started well.

Despite the majority of households in Kosovo having access to the internet both via fixed and mobile broadband connections, 38.7 per cent of the country’s population...

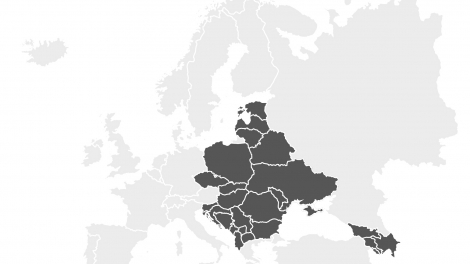

After four years of turmoil, Ukraine may finally be turning a corner. The country’s volatile economy is stabilising, and President Petro Poroshenko has pushed through a...

Two Estonian-led start-ups, TransferWise and Monese, are changing the face of banking for the better.

From fashion to passenger vehicles, an ever-increasing number of Polish companies set up in the 1990s are prospering beyond their home market. We take a look at what's...

Citizenship and residency by investment – known by the acronym CRBI – has become a fully-fledged industry, with a number of organisations increasingly worried that it is...

In an era of digitalisation and e-commerce, the region’s shopping centres have no other choice but evolve, from merely being places to shop to offering a well-rounded...

Poland’s Ministry of Maritime Economy and Inland Navigation (MGMiŻŚ) is in the process of developing a Maritime Development Fund (MFR), in the hope of rejuvenating...

Ensuring a secure supply of energy is a challenge for many European countries, not least in emerging Europe.

With the number of pensioners in Poland set to outnumber the working-age population by 2060, a recent article in the news magazine Plus Biznesu (PB) has suggested that...

Companies investing in emerging Europe are no longer simply looking for the cheapest option. Quality and innovation are increasingly important.