‘The robust growth of the economies of Central Asia and the weaker performance of those in Central Europe and the Baltic states reflect the different consequences of energy prices, inflation and shifting patterns of trade.’

The economies of Central Asia, the Caucasus and Turkey are expected to maintain strong growth in 2023, offsetting a weaker performance in emerging Europe, according to the European Bank for Reconstruction and Development’s (EBRD) latest Regional Economic Prospects report.

In Central Asia and parts of the Caucasus region, the stronger economic performance is expected to result from solid trade growth and high levels of remittances from Russia. In emerging Europe, the deceleration reflects high energy prices, persistent inflation (averaging 9.7 per cent in the EBRD regions in July 2023) and slow growth in advanced Europe.

- For CEE, transitioning to sustainable heating is both a challenge and an opportunity

- For the US, Central Asia poses a conundrum

- Rail instead of lorries: The climate effect of a ‘European Silk Road’

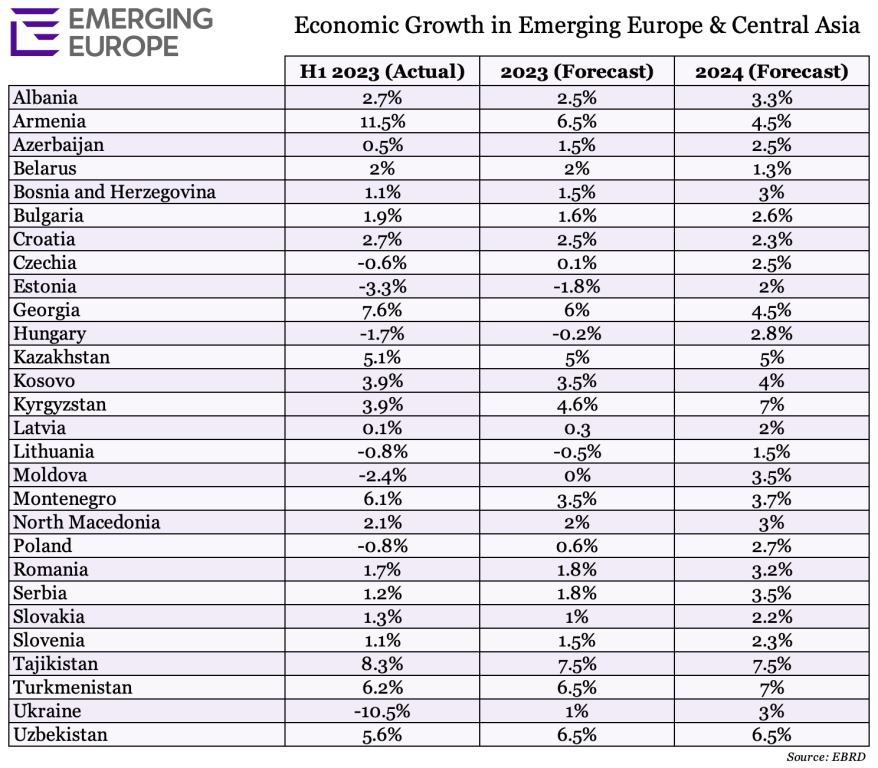

Growth in the EBRD regions is expected to slow to 2.4 per cent in 2023 from 3.3 in 2022. In 2024, as inflation continues to ease, growth is expected to pick up to 3.2 per cent. The figures reflect an upward revision of 0.2 percentage point to May’s forecast for 2023 and a downward revision of 0.2 per cent to the forecast for the following year.

“Our economists see a diverging pattern of growth among the EBRD regions,” says EBRD Chief Economist Beata Javorcik.

“The robust growth of the economies of Central Asia and the weaker performance of those in Central Europe and the Baltic states reflect the different consequences of energy prices, inflation and shifting patterns of trade.”

Trends

There are a number of trends influencing the latest economic forecast.

Gas consumption in emerging Europe fell by more than 20 per cent in the winter of 2022-23 as the reduced supply of gas from Russia resulted in much higher energy prices. Oil and gas prices, though back to below levels preceding the war on Ukraine, continue to weigh on the region’s growth.

European industry has shifted away from gas-intensive sectors, such as construction materials, chemicals, base metals and paper, while increasing production in less carbon-intensive sectors, such as electrical equipment, car manufacturing and pharmaceuticals.

In Poland, for example, base metals production declined by 18 per cent year on year, while electrical equipment production increased by 21 per cent year on year.

Overall, total industrial output in Europe has been lower than expected, contributing to slower economic growth. Nevertheless, the labour market has remained resilient, with companies retaining jobs despite large changes in the structure of output. And, amid high inflation, nominal wages have increased rapidly in many economies. In some cases, such as in the Baltic states and Hungary, wage increases have outpaced productivity growth, reducing competitiveness.

In contrast, growth in the economies of Central Asia and certain countries in the Caucasus remained strong year on year in 2022 and the first half of 2023. This was due to intermediated trade to and from Russia, as well as high levels of migration to and subsequent remittances from Russia, which underpinned robust real wage growth.

Regional projections

In Central Europe and the Baltic states, where high costs for food and energy tightened households’ budgets and small and medium-sized enterprises’ access to finance for investment has been reduced, growth is expected to average 0.5 per cent in 2023, down from 3.9 per cent in 2022, and rise to 2.5 per cent in 2024.

A weaker external environment and the impact of inflation in EBRD economies in the south-eastern European Union is expected to lead to growth of two per cent in 2023 and a pick-up to 2.8 per cent in 2024.

In the Western Balkans, the effect of weakening trade with Eurozone partners at the beginning of 2023 was partly offset by the strong performance of the tourism sector in the region’s service-based economies. GDP is projected to grow by two per cent in 2023 and reach 3.4 per cent in 2024.

Growth in Central Asia is forecast to remain robust, at 5.7 per cent in 2023 and 5.9 per cent in 2024. Drivers include government spending, China’s demand for commodities, intermediated trade with and exports to Russia, and remittances and the relocation of companies from Russia.

In Eastern Europe and the Caucasus, economies have been adjusting to the extreme shock caused by the war on Ukraine. The forecast sees GDP growth of 1.9 per cent in 2023 and a rise to 3.1 per cent in 2024.

In Ukraine, GDP growth of one per cent is expected for 2023, reflecting a sharp year-on-year contraction in the first quarter. This is likely to be followed by an increase of three per cent in 2024.

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.