A unique trading solution targeted at the next generation of investors. That’s what Evarvest, a start-up based in Vilnius, Lithuania, will soon be launching, a product that will provide users with an easy, transparent and low-cost way to access stocks, bonds and Exchange Traded Funds in over 30 stocks markets around the world.

“I was personally struggling with being able to access global stock markets, as it is very difficult to access these and even when you can the costs are very high,” founder and CEO Stephanie Brennan tells Emerging Europe.

“I am trying to change that, as we are aware that the finance industry can’t keep up with the needs and expectations of modern investors the way that tech companies like Facebook, Uber and Spotify can. Today, people need easy, quick and inexpensive investment solutions, which aren’t restricted by any barriers.”

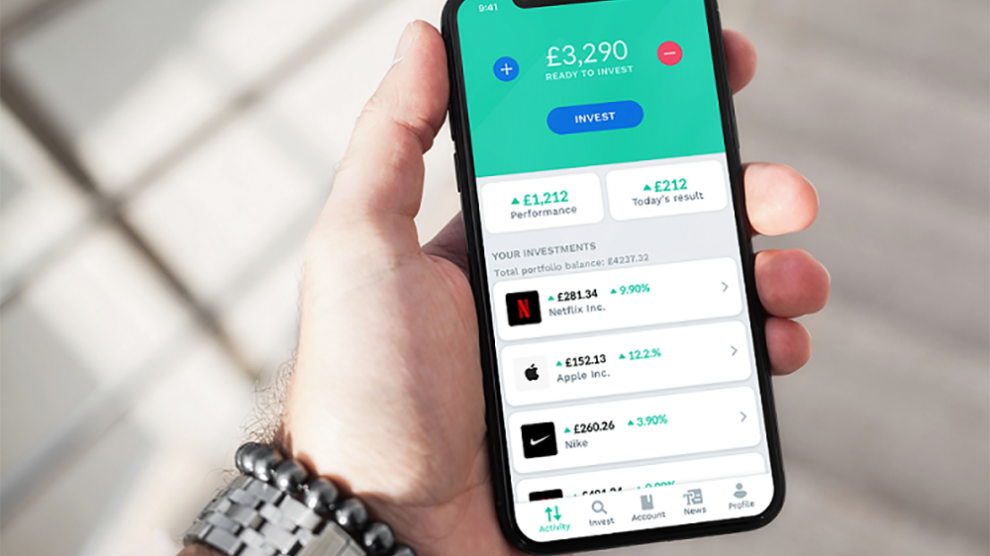

The solution developed by Evarvest doesn’t look like traditional trading apps. With its functional and user-friendly interface, easy picking stock playlists, no minimum account balances and incentives for community engagement, it is more similar to popular social media platforms. Its users will be able to create and share their own portfolios as well as follow the portfolios of their friends and Evarvest top-performing investors. Another important feature implemented in the app will be a new kind of watchlist, one that tracks your returns once a stock is added. This acts as a practice portfolio, where users will be able to try their investment strategies, for free and with no risk.

“Our app will make it possible to invest in some of the world’s most recognisable brands with just two clicks on a mobile, and with little to no cost, so your investment returns are not being diluted by fees,” Mrs Brennan continues.

Apart from trading services, users of the Evarvest app will also have access to a built-in news feed section and dedicated educational library created by the company in order to promote financial literacy and help people make wise investment decisions, securing their financial future.

“Stock markets are difficult for people to understand. This is why we created an educational library which is now being used by investors in more than 56 countries. We translate everything that is challenging in an easy way, so that everybody can understand. People know Uber, for example, they trust it and they know the business model behind it, so it’s far easy to then explain the more technical detail behind investing in a company like Uber. This knowledge can then be transferred to other investment opportunities they are curious about,” Mrs Brennan adds.

Evarvest wants the app to make stock market trading more accessible to all, and that includes women, currently underrepresented in what remains a male-dominated field.

“We are trying to support more women as well, by giving them access to the brands and industries they use in their daily life, such as fashion companies that are all publicly listed. Often investing in brands and industries you know, increases your confidence with investing”, Mrs Brennan says.

Evarvest moved its headquarters to Vilnius, Lithuania in order to enter the European market. Currently, it is in the process of obtaining a UK financial licence and preparing for a financial brokerage licence granted by the National Bank of Lithuania and regulated by the European Central Bank.

“We researched the regulations globally for the license we needed and Lithuania turned out to be the best choice,” Mrs Brennan explains. “It has the fastest licensing process in Europe, the one license gives us access to expand across the EU and the National Bank of Lithuania has been really helpful in supporting us.”

“Of course, there is also the other side. I am from Australia so expanding into new geographies means addressing issues related to that geography, this also means we need to create a different experience for different users of our app. But our development team here in Lithuania are highly skilled and their knowledge is far more advanced than previous development teams we have worked with in Australia and internationally, as is our CTO’s knowledge and experience.”

As part of future plans, Evarvest would like to expand first across Europe, and then reach the US and Australia.

“We already have people using our educational libraries in countries outside the EU like, Belarus and Ukraine, and we now want to be able to support them too. When it comes to technology, the world is less diverse. It is not the topic that divides countries, but access to these platforms and their costs”, Mrs Brennan concludes. “But not everything can be about supporting the next generation of investors, so I would also like to move into pension funds and give easier access and educational tools to older people as well. Pensions are underperforming across the globe and this needs to change, for older generations as well as for our generation and all future generations that come behind us.”

—

Photos: Evarvest

Add Comment