Emerging Europe’s start-up scene is thriving: new money and new ideas are coming onto the market all the time. To keep you up to date with the latest investments, innovations, movers and shakers, each Monday Emerging Europe brings you a round-up of the region’s start-ups which recently closed financing rounds, sealed partnerships, or dropped new innovations.

Veriff: Estonia’s latest unicorn

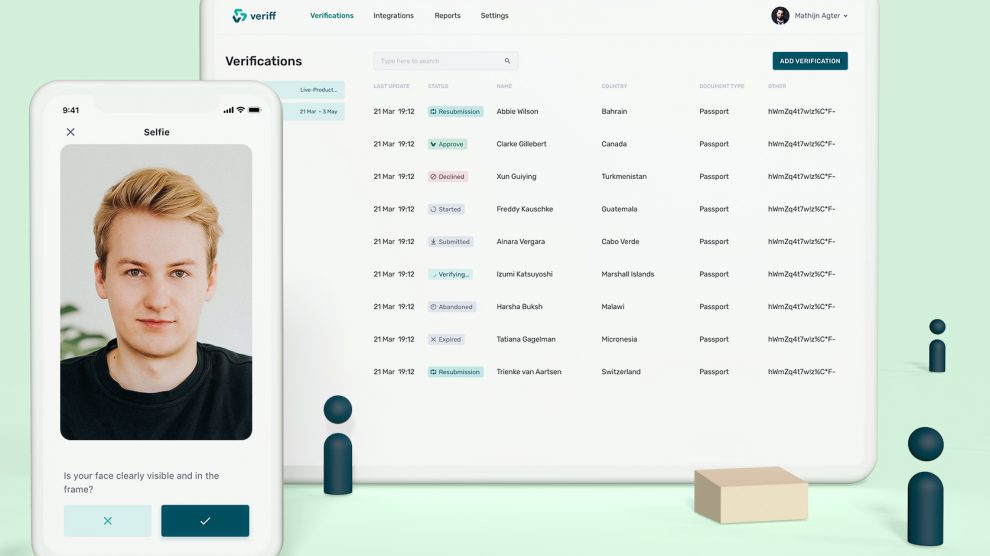

Estonia has another unicorn, identity verification (IDV) start-up Veriff, a firm that has the goal of offering everyone in the world a single digital identity.

In a series C funding round, co-led by Tiger Global and Alkeon, joined by existing investors IVP and Accel, the firm raised 100 million US dollars, bringing Veriff’s total funding so far to 200 million US dollars and a valuation of 1.5 billion US dollars.

Veriff joins Skype, Playtech, Wise, Bolt, Pipedrive, ID.me and Zego in reaching a valuation of one billion US dollars or more.

Founded in 2015, Veriff aims to protect businesses and their customers from online identity fraud by making sure that a person is who they claim to be. Driven by artificial intelligence, Veriff’s technology can analyse and verify thousands of technological and behavioural variables in seconds.

The new financing will be used to accelerate Veriff’s global growth and invest in research and development, especially to advance product expansion. The company will also grow its sales and marketing teams to onboard more global clients and build on recent customer success programmes.

In addition, Tallinn-based Veriff will expand its global workforce, currently 360 strong.

Nextgen banking platform Tuum raises 15 million euros

Tuum, a next-generation core banking platform based in Tallinn, Estonia, this week announced a 15 million euros Series A round of funding.

Portage Ventures is leading the round, joined by existing investors Blackfin Capital Partners and Karma Ventures. The round will enable Tuum – formerly known as Modularbank – to continue investing in product innovation and support global growth, focusing initially on strengthening its EU and UK presence. The new funding announcement follows a robust year of growth, with Tuum’s contracted annual recurring revenue increasing more than three times in 2021 compared to the previous year.

Founded in 2019 by experts in banking and financial technology, Tuum has created an extremely flexible, lean, and modular platform that caters to a broad range of clients. Tuum’s cloud-agnostic core banking platform enables banks, fintechs, and traditionally non-financial companies to quickly and easily roll-out new financial products and services. Empowered by Tuum’s technology, these businesses can better address the needs of their customers, increase sales, and foster loyalty.

Tuum is keen to invest more in both its existing markets and, using the prominence and industry expertise of its new lead investor Portage Ventures, beyond Europe. The funding will initially be used to expand operations in the UK, offering on-the-ground support to customers in its biggest market. It will also fund essential R&D efforts to continue enhancing and expanding the Tuum product portfolio. In addition, Tuum will deploy the new funding towards further investment in its team, projecting to double the team to 140 employees by the end of 2022.

Eleven Ventures closes third fund at 60 million euros

Eleven Ventures, a Bulgarian venture capital firm focused on pre-seed and seed investing in South-Eastern Europe has announced the final closing of its Eleven Fund III at 60 million euros.

The new fund includes many repeat investors, including the European Investment Fund, as well as 60 individual investors from the tech industry. Eleven did an IPO in March 2020 on the Bulgarian Stock Exchange, with 20 portfolio companies under the Eleven Capital public entity.

Established in 2012 by Daniel Tomov and Ivaylo Simov, later joined by Vassil Terziev, a successful Bulgarian tech entrepreneur, Eleven Ventures has made 150 collective investments over nine years, and has been instrumental in catalysing the regional start-up ecosystem, supporting tech companies in five priority verticals – Healthcare, Future of Food, Fintech, Future of Work and Ecommtech.

Eleven has backed several prominent start-ups, including SMSBump, Payhawk, Gtmhub, Dronamics, Kanbanize and Nitropack.

“Our job is to seek out the local heroes in Southeast Europe and give everything we have to support their growth and global outreach. We’re trying to inspire the local entrepreneurial community to look beyond the region’s ecosystem and have more daring aspirations,” says Simov.

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.

Add Comment