Central and Eastern Europe’s further integration into the global supply chain presents a unique set of opportunities for the region to drive economic development, foster innovation, and play a pivotal role in shaping the future of global trade.

The global supply chain is a labyrinthine ecosystem of production, logistics, and trade, linking just about every region of the world. Central and Eastern Europe, long viewed as a peripheral player, has over the past two decades emerged as a pivotal hub in this interconnected system.

Countries in the region are increasingly leveraging their geographic, economic, and talent advantages to become crucial nodes in a range of industries.

The geopolitical landscape (firstly the Covid-19 pandemic and more recently Russia’s war on Ukraine) has accelerated the region’s transformation. Both the pandemic and conflict not only caused immediate disruptions but also raise questions about the long-term stability and security of supply chains.

The implications are clear and underscore the importance of diversifying supply chains and potentially relocating closer to home markets to mitigate risks associated with geopolitical conflicts, transportation costs, and delays.

- The future of manufacturing in CEE: Transitioning to a high-tech, added value era

- As ESG moves front and centre, what does it mean for CEE’s supply chains?

- Reimagining Central and Eastern Europe’s future development through the Three Seas Initiative

As early as May 2022, just a couple of months after Russia launched its invasion, a major report from the Centre for Economic Policy Research (CEPR) was warning that the war could “permanently” alter global supply chains. KPMG meanwhile was suggesting that companies need to “re-evaluate localisation vs. globalisation”.

Warning that while over the past 30 years globalisation of supply chains has benefited countries and corporations alike, KPMG noted that in recent years, support for globalisation has fallen, trade tensions have risen, and Covid-19 demonstrated the vulnerabilities of global just-in-time supply chains.

According to the latest PwC Global CEO survey, more than a third (37 per cent) of the CEOs in Central and Eastern Europe view supply chain instability as as the biggest driver of how they will do things differently over the next three years.

An enhanced role in automotive sustainability

Few sectors demonstrate this shift as much as the automotive industry. Central and Eastern Europe has become a vital link in the global automotive supply chain, with countries such as Poland, Czechia, Hungary, Slovakia and Romania at the forefront.

These nations have attracted significant investments from global automotive manufacturers, driven by a combination of skilled yet competitively priced labour, a strategic location, and favourable economic policies. It is also worth noting that the region’s contribution to the automotive industry is not limited to traditional manufacturing of petrol and diesel-powered vehicles but extends to the increasingly crucial field of electric vehicles (EVs), where it is poised to play a significant role in battery production and assembly.

For instance, Slovakia has one of the highest car production rates per capita, hosting major manufacturers like Volkswagen, Kia, and Peugeot. Poland and Czechia have also seen substantial investments, with companies such as Toyota and Hyundai expanding their operations.

This automotive boom is supported by a network of suppliers and sub-suppliers based in the region, creating a dense ecosystem of automotive production.

Investments are not only about expanding production capacities but also about innovating for the future. The push towards electric vehicles has seen countries in Central and Eastern Europe becoming pivotal in the supply chain for EV components.

For example, LG Chem’s decision to establish a major EV battery plant in Poland—the largest in Europe—underscores the region’s growing importance in the automotive industry’s shift towards sustainability.

“We are committed to establishing a robust supply chain in the region and expediting its transition to sustainable mobility,” said LG’s Hong Seung-taek late last year.

From outsourcing to innovation

When it comes to manufacturing, Poland—along with Hungary—has been the region’s largest beneficiary of the nearshoring trend, according to FDI Intelligence. In IT, other players are making the most of their moment.

Central and Eastern Europe long ago carved out a significant niche for itself in the global IT outsourcing and technology innovation landscape. Countries like Ukraine, Romania, and Poland are recognised for their highly skilled IT workforces, competitive cost structures, and rapidly evolving tech ecosystems.

These countries offer a compelling blend of technical expertise and innovation, making them attractive destinations for international companies looking to outsource IT services or establish research and development centres.

Ukraine, before the Russian invasion, was emerging as a leading IT outsourcing destination, with a robust growth in software development and IT services exports. The country’s IT sector boasted a workforce of over 200,000 professionals, contributing significantly to the global software and technology market. Similarly, Poland and Romania have become hubs for tech companies, from start-ups to tech giants, seeking to tap into the regions’ tech talent pool and innovative capabilities.

Key factors driving this growth include a strong educational focus on STEM fields, governmental support for the tech industry, and an entrepreneurial culture that fosters innovation. This environment has led to the emergence of Central and Eastern Europe as a powerhouse in software development, cybersecurity, and artificial intelligence (AI), with companies in the region delivering projects for global clients and contributing to cutting-edge technological advancements.

Significant projects and collaborations have underscored the region’s capabilities, such as Romania’s role in developing cybersecurity solutions for multinational corporations or Poland’s booming gaming industry, which has become one of its most important exporters. In the north, Estonia is a unicorn factory, while Lithuania boasts one of the only fintech sandboxes in the world.

These developments reflect the region’s growing importance in not just outsourcing but also in contributing to Europe definitively claiming a place at tech development’s top table—an ambition that the European Union has openly pursued.

Vulnerability and resilience

Nevertheless, while Russia’s war on Ukraine has bolstered Central and Eastern Europe’s role in the global supply chain, it has highlighted both vulnerabilities and resilience within the region. Initially, the conflict caused significant disruptions in logistics and supply routes, particularly for industries heavily reliant on Ukrainian and Russian resources, such as energy and raw materials.

The immediate impacts included interruptions in the delivery of goods, increased costs due to rerouted supply chains, and a general atmosphere of uncertainty affecting investment and operational decisions. For example, the automotive industry faced challenges due to the scarcity of specific components previously sourced from the region, leading to production delays and increased operational costs.

Beyond the immediate logistical hurdles, the conflict has precipitated broader geopolitical shifts. Sanctions imposed on Russia and countermeasures have disrupted traditional trade routes, prompting businesses and countries in the region to seek alternative suppliers and markets. This reorientation has accelerated the diversification of supply chains, with companies increasingly exploring options within the region or in other parts of the world less susceptible to geopolitical tensions.

Despite these challenges, most of the region’s countries have demonstrated remarkable resilience. Governments and businesses have been quick to adapt, implementing contingency plans and investing in infrastructure to mitigate the impact of the conflict.

The crisis has also spurred a re-evaluation of regional cooperation and economic integration, with an increased focus on strengthening intra-European trade relationships and reducing dependency on volatile markets. It should also lead to an improvement in intra-regional infrastructure, which has long been neglected in favour of East-West connections.

The Three Seas Initiative (3SI) is at the forefront of this movement, mobilising investments across energy, digital, and transport to bridge the significant infrastructure gap that has long set the CEE region apart from its Western European counterparts.

“[The 3SI] is not solely concerned with building physical infrastructure; but about laying the groundwork for a future where the CEE region is championed as a formidable player on the global stage,” says Christian Roy, senior investment director at Amber Infrastructure (the investment advisor of the Three Seas Initiative Investment Fund).

A robust foundation for future growth

Central and Eastern Europe’s role in the global supply chain is undergoing a significant transformation.

Once peripheral players, countries in the region are now central to the operations of industries as diverse as automotive manufacturing and IT. Their strategic geographic location, coupled with a commitment to technological innovation and a skilled workforce, has cemented their position as vital links in the global supply chain network.

However, the path forward is not without its challenges. Geopolitical tensions, infrastructure needs, and the imperative for continuous technological advancement are pressing issues that require concerted efforts from governments, businesses, and international partners. Yet, the resilience and adaptability demonstrated by the region, especially in the face of recent challenges, betrays a robust foundation for future growth.

Looking ahead, Central and Eastern Europe’s integration into the global supply chain presents a unique set of opportunities for the region to drive economic development, foster innovation, and play a pivotal role in shaping the future of global trade.

By making the most of the current geopolitical landscape and investing in the future, the region can not only enhance its position in the global economy but also contribute to a more diversified, resilient, and sustainable global supply chain.

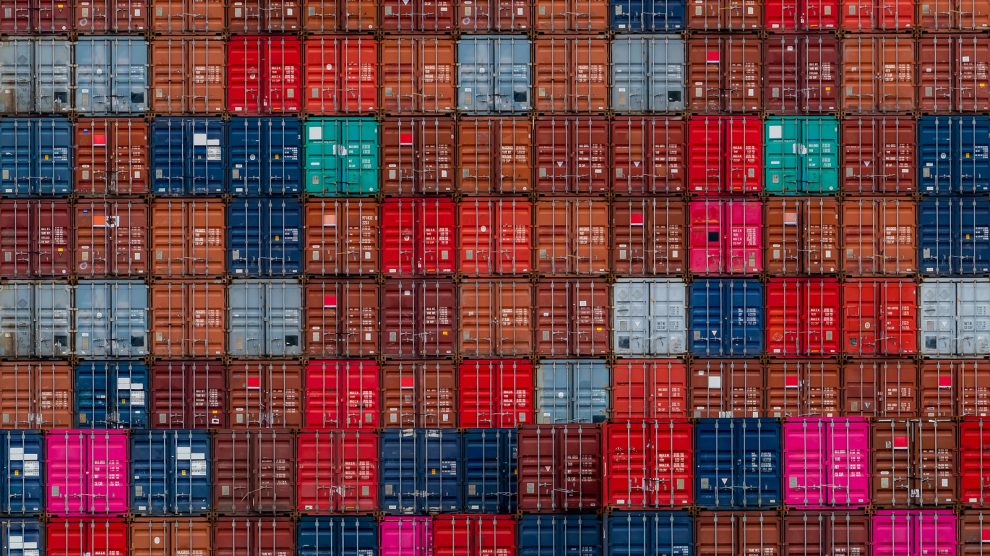

Photo by Arno Senoner on Unsplash.

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.