Central Asia is expected to see a slight decline in growth from 5.7 per cent in 2023 to 5.4 per cent in 2024, but will still see Eurasia’s highest levels of growth—much of it driven by a soaring ICT sector.

The European Bank for Reconstruction and Development (EBRD) expects output in its regions to grow by three per cent in 2024, up from 2.5 per cent in 2023, despite challenges stemming from global geopolitical tensions, including growing limitations on trade, according to its latest Regional Economic Prospects report published this week.

Growth in the Bank’s regions is projected to pick up further in 2025, to 3.6 per cent.

- The indisputable benefits of EU membership

- The success of the EU’s 2004 enlargement must drive a new wave of expansion

- Bridging economies: The catalyst role of low-cost cross-border payments in the Western Balkans

The new report, Taming Inflation, showcases an easing of inflationary pressures relative to last year, which was marked by economic slowdown due to high energy prices resulting from the war on Ukraine and post-Covid recovery.

While growth is expected to accelerate, the forecast is slightly below last September’s projections, with a downward revision of 0.2 percentage points. This is partly due to slower-than-expected growth in early 2024 across central Europe and the Baltic states, echoing Germany’s sluggish economic performance.

Southern and eastern Mediterranean economies face weak growth as a result of the spillovers from the war in Gaza and reduced fiscal stimulus in Egypt, while Central Asia’s growth contributions from intermediated trade are levelling off, and are expected to be more modest in the future. A booming ICT sector, however, is seeing unprecedented levels of high growth.

The battle against inflation

As energy and food prices moderated since 2022, inflation in the EBRD regions fell to an average of 6.3 per cent in March 2024 from a peak of 17.5 per cent in October 2022. While this drop was quicker than expected a year ago, inflation remains two percentage points above pre-pandemic levels. This pattern mirrors trends in advanced economies, where inflation has declined but remains above central banks’ targets.

The forecast notes slower disinflation in EBRD countries with larger budget deficits and weaker macroeconomic frameworks.

“While disinflation has been faster than expected, inflation in some of our countries remains high,” says Beata Javorcik, the EBRD’s Chief Economist.

“The outlook is subject to significant risks, particularly from the escalation of geopolitical tensions and its unwanted economic effects. While the current shifts in trade and investment relationships may benefit some individual economies, let’s not forget that globally, geopolitical fragmentation leads to inefficiencies and higher volatility.”

The report describes how geopolitical tensions are impacting the Bank’s economies, leading to rapid fragmentation in trade and increased defence spending, while eroding the peace dividend—the economic benefit resulting from a reduction in defence expenditure and a subsequent reinvestment of funds in the civilian economy.

Since February 2022, arms trade as a share of imports and exports of the European Union economies in the EBRD regions increased from 0.1 per cent to 0.3-0.5 per cent. Countries are increasingly trading certain goods only with certain partners. “Bridging” economies which trade with both eastern and western blocs have been large recipients of foreign direct investment (FDI) and stand to benefit from fragmentation.

Inward FDI from China to the EBRD regions picked up sharply in 2023. Similarly, investment from Russia to Central Asia has been rising, particularly in logistics services.

Geopolitical pressures are also reflected in the elevated borrowing costs observed in the EBRD countries in the EU. The median yield on five-year government bonds increased by three percentage points from early 2022 to April 2024 across the Bank’s regions.

EU accession bonus

May 2024 marks the 20th anniversary of the EU accession of eight economies where the EBRD invests: Czechia, Estonia, Hungary, Latvia, Lithuania, Poland, the Slovak Republic and Slovenia.

Over the past two decades, these countries have experienced significant growth in their per capita incomes, transitioning from being only about a quarter as affluent as Germany in 2003 to achieving half its GDP per capita by 2023.

This was faster than the speed with which other emerging markets at similar levels of development were converging with advanced economies. The swift convergence can be largely attributed to the “EU accession bonus”, which was facilitated by rapid growth of exports relative to GDP as these economies integrated more deeply with the European and global supply chains.

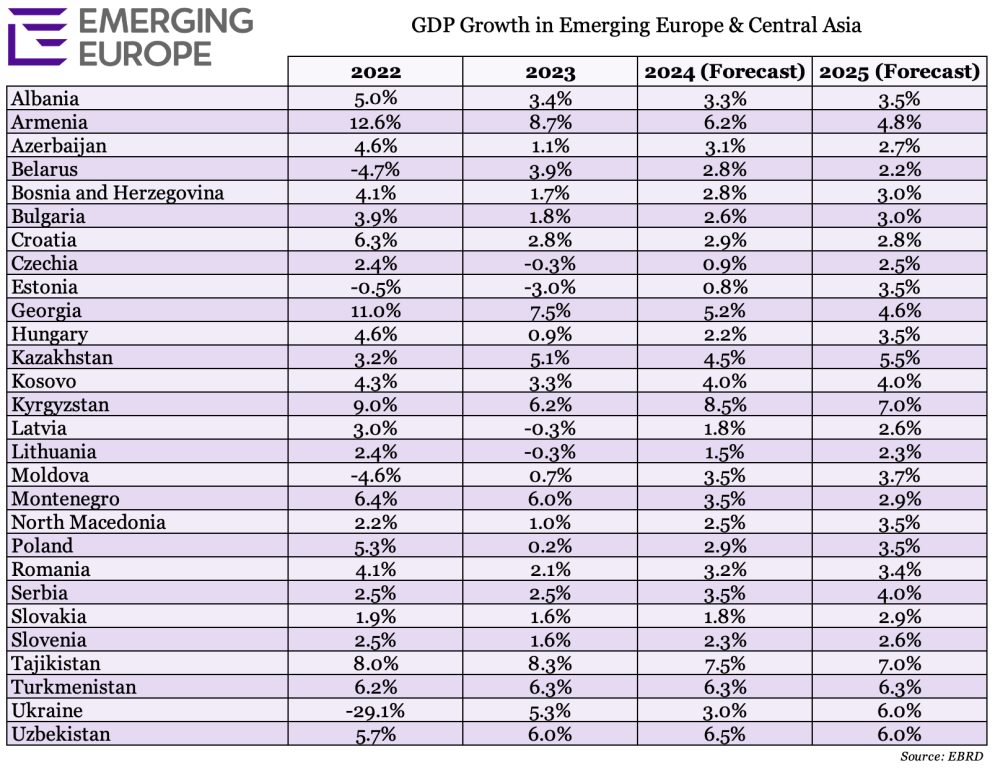

Regional growth projections

The growth outlook in Central Europe and the Baltic states is expected to gradually improve, with 2024 projections being at 2.2 per cent and accelerating further to 3.1 per cent in 2025. Yet, growth forecasts in several economies have been revised down since September 2023 due to weak economic activity in recent months.

In the EBRD countries in the south-eastern EU, GDP growth is projected to pick up from two per cent in 2023 to 2.8 per cent in 2024, supported by accommodative fiscal stances and robust real wage growth.

Similarly, the Western Balkans region expects growth to increase to 3.3 per cent in 2024 from 2.5 per cent last year.

Central Asia is expected to face a slight decline in growth from 5.7 per cent in 2023 to 5.4 per cent in 2024, as intermediated trade with Russia appears to have reached a plateau, while spring floods weigh on Kazakhstan’s growth prospects. However, a rebound is expected in 2025, to 5.9 per cent.

Growth in the Caucasus is forecast to be moderate at 4.1 per cent in 2024 before settling closer to 3.5 per cent in 2025, a level in line with estimates of medium-term potential growth.

Ukraine’s output expansion meanwhile is expected to be held back in 2024 due to significant recent damage to electricity infrastructure. Limited domestic demand, labour shortages and insufficient investments will also likely constrain growth prospects, the report says.

However, a recovery of exports and the expansion of domestic military production will likely generate economic growth of three per cent in 2024 accelerating to six per cent in 2025.

Impressive ICT growth in Caucasus, Central Asia

The EBRD’s report notes that the Caucasus and Central Asia have seen an uptick in ICT, in large part a result of highly skilled Russian professionals choosing to relocate to the Caucasus and Central Asia, taking advantage of linguistic and cultural proximity and the relative ease of gaining residence and opening bank accounts.

Russian relocanty include large numbers of entrepreneurs, as well as experienced IT and creative industry personnel. For instance, Georgia is estimated to have received more than 20,000 Russian tech professionals and more than 21,000 legal entities (firms) were established by Russian entrepreneurs between March 2022 and July 2023.

Kazakhstan has seen a doubling in the number of entities with Russian participation (19,000 firms as of October 2023 compared with around 8,000 in 2021), driven by a fivefold increase in ICT businesses. Armenia has seen a doubling in the number of ICT sector employees in 2022, with some multinational corporations, such as Nvidia, moving whole teams from Russia and opening research and development centres in Yerevan.

Caucasus and Central Asian economies introduced comprehensive “absorption” packages targeted at these professionals, including generous tax benefits, streamlined work permitting procedures and relocation support for companies and individuals registered with specially designated economic zones, such as the Astana Hub in Kazakhstan, Uzbekistan’s IT Park and Kyrgyzstan’s High Technology Park.

As a result, the ICT sectors have been developing rapidly. For instance, Kyrgyzstan’s High Technology Park’s revenues increased by 70 per cent between 2022 and 2023 (95 per cent of its revenue come from ICT exports). The number of (local and foreign) companies registered with the park increased from 228 in 2022 to 383 in 2023.

IT exports by Uzbekistan’s IT Park increased 2.4-fold relative to 2022, while Astana Hub’s IT exports increased by 84 per cent year on year in 2023. With significant real estate at its disposal, Uzbekistan’s IT Park introduced a new “Zero Risk” programme granting participating companies free office space for one year, assistance with office equipment, and partial reimbursement of local personnel salary and training costs (effectively amounting to a negative income tax).

Photo by Frankie Lu on Unsplash.

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.