Bulgarian voters headed to the polls for the fourth time in less than two years on October 3, but the chances of a functioning government emerging from its aftermath are slim.

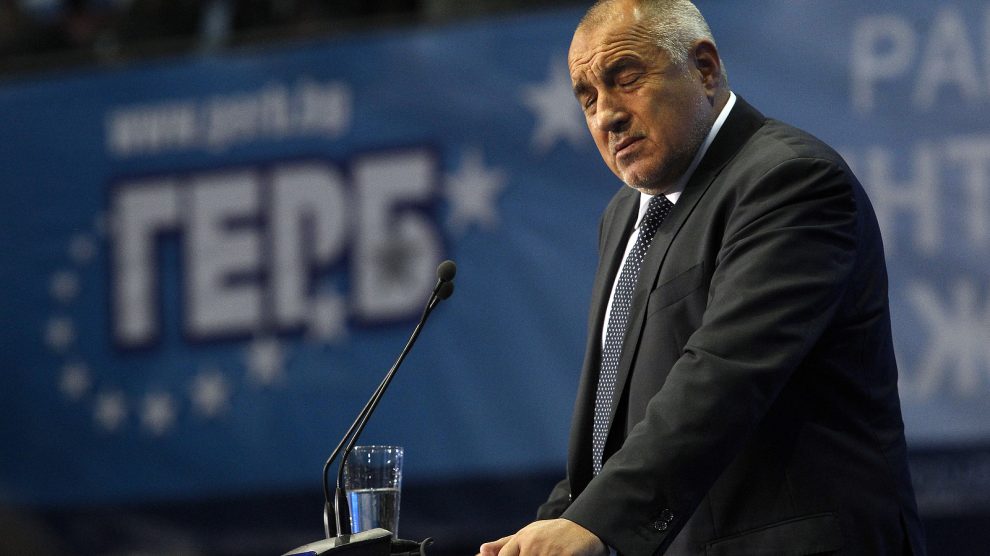

GERB, a nominally centre-right party led by a controversial former prime minister, Boyko Borissov, is set to emerge as the largest party following Bulgaria’s fourth parliamentary election in less than two years.

The party, which has become a byword for systematic corruption, nevertheless took more than 25 per cent of the vote, followed by the We Continue the Change (PP) party of another former prime minister, Kiril Petkov, on 20 per cent.

“It is now GERB’s responsibility to form a government,” said Petkov following the release of the first results. “But we have promised that we will never participate in a coalition with GERB and we will keep that promise.”

- Political instability and economic uncertainty stalk Bulgaria, again

- North Macedonia – and with it Albania – might finally have overcome key obstacle on EU path

- A backpacker’s paradise: Travelling by bus to North Macedonia and Kosovo

It was the collapse of Petkov’s fragile coalition in June – after just eight months in office – which brought about the latest election, when the populist There Is Such a People party (ITN) withdrew from the government following a dispute over the country’s budget.

ITN, led by the TV personality Slavi Trifonov, had also objected to what has become known as the French Compromise, which saw Bulgaria finally lift its veto of North Macedonia’s EU accession talks. ITN has now, however, seen its vote collapse, and could even miss out on the four per cent threshold required to send MPs to parliament.

In all, seven parties look to have reached the threshold. Besides GERB and PP, the others are the Movement for Rights and Freedoms (DSP), which draws its votes primarily from Bulgaria’s Turkish minority, the nationalist Vazrazhdane (Revival) party which wants to take the country out of both the EU and NATO, the Bulgarian Socialists, the anti-corruption Democratic Bulgaria party, and another nationalist party, Bulgarian Rise, formed only in May.

While it could be several days before the final results are known, it is already clear that it will be difficult for Borissov to form a government.

“It will be hard to build a stable coalition given the antagonism of the other major parties, even if Borissov steps down as a GERB leader, which was depicted as a major negotiation demand before the vote,” says Yasen Georgiev, head of the Economic Policy Institute, a Bulgarian think tank, who adds that the other parties will not be able to replicate the last coalition government.

“Therefore, a new snap election vote is not to be excluded,” he tells Emerging Europe.

Prior to the vote, Borissov had indicated that he would be open to talks with to all political parties and appealed to his rivals to show “reason” ahead of what is likely to be a difficult winter.

“The current caretaker government, or a new coalition, has to cope with a rising budget deficit due to increased budget spending commitments taken by its predecessors,” says Georgiev. “Rising inflation and energy prices will additionally affect its room for maneuver.

“In order to mitigate this, it is crucial that the new EU’s operational programmes are finally put into operation and planned investments under country’s Recovery and Resilience Plan are implemented as soon as possible.”

Rising inflation

Following a contraction by 4.4 per cent in 2020, Bulgaria’s economic recovery gained momentum in 2021, growing by 4.4 per cent, with export and consumption acting as the main growth engines.

However, while growth remained quite resilient in the first half of 2022 at 4.5 per cent year-on-year, momentum has declined amid rising inflation – over 17 per cent in August – and decreasing consumer confidence.

According to the European Bank for Reconstruction and Development (EBRD), investment declined sharply in the second quarter, as firms confronted increased uncertainty, and was 14 per cent below pre-pandemic levels.

Due to the robust performance in the first half of the year, the bank’s GDP growth forecasts for 2022 remain at three per cent, but uncertainty over gas supply – Russia had been meeting more than 90 per cent of its gas needs until April, when Gazprom cut supplies over Bulgaria’s refusal to pay in roubles, weakening domestic and foreign demand amid high inflation and deterioration of confidence, as well as the ongoing political uncertainty, could translate into modest growth of 1.5 per cent in 2023.

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.