Slovak fintech startup altFINS, a cloud-based platform allowing investors and traders to track and analyse digital assets across various platforms, has raised one million euros of investment in a seed round led by CB Investment Management.

altFINS bills itself as a comprehensive and intuitive way for investors and traders to aggregate data and news and to analyse the altcoin market. In turn, this lets them execute trades with more confidence and manage their digital assets portfolios across many different exchanges.

Since the creation of Bitcoin in 2019, cryptocurrencies have spread fast and become popular among investors and traders. However, even today, the cryptocurrency ecosystem is fragmented into many different exchanges. According to the Bratislava-based company there are about a thousand different digital assets traded over 300 crypto exchanges.

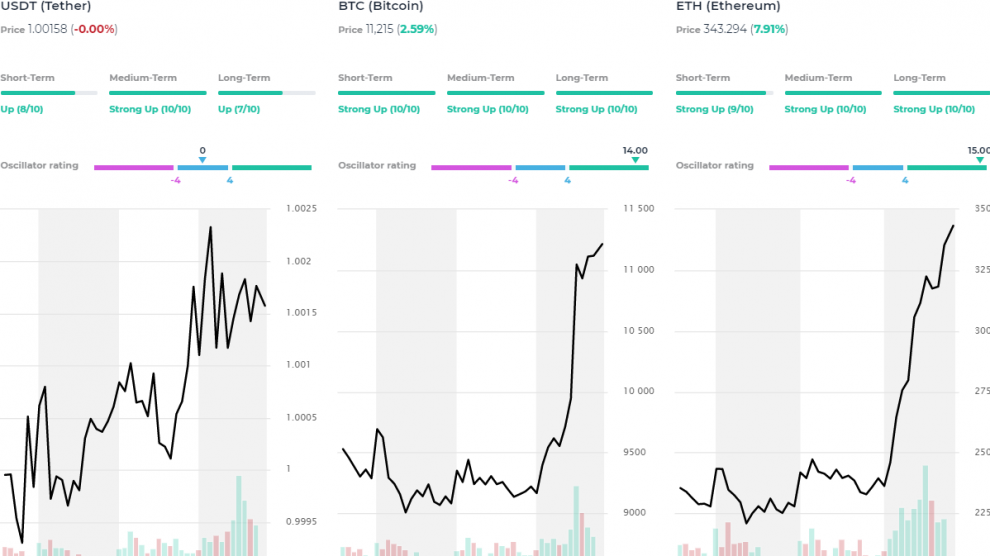

This vast number of assets and exchanges can make it hard for investors and traders to accurately track what goes on in the market. That is where altFINS steps in, as their platform focuses on pre-trade and post-trade analytics to help traders generate ideas and understand their performance across the different exchanges.

The company manages to do this with a proprietary data management system which takes in real-time, tick-level data from the exchanges and calculates 60 different technical indicators across seven time intervals.

“altFINS brings an innovative approach to much-needed transparency to the growing digital assets market. A platform that combines trade idea discovery and execution with fundamental analysis is truly unique in the crypto trading space,” says Dano Gašpar, partner of CB Investment Management.

“altFINS has found a void at the market that suffers from lack of high-quality tools for investment analytics and fails to address the need for professional digital assets management infrastructure at the same time.”

CB Investment Management is a seed fund that invests in young Slovak companies with potential for international growth. The fund is owned by Crowdberry, a network of 3,000 private investors and the largest alternative investment platform in Czechia and Slovakia.

“Immediately following our first interactions, it was clear that CB Investment Management team recognizes the long-term potential of this new asset class and the disruptive nature of underlying blockchain technology,” says Richard Fetyko, founder of altFINS.

The company will now use the one million euros to further expand the platform’s capabilities and scalability, allowing even more traders to make informed decisions and to expand globally.

“We believe in the strong growth potential of altFINS on a global scale, especially now in an era of financial uncertainty in the traditional markets,” Mr Gašpar adds.

And there is room for growth as the crypto-market shows a long-term trend in global adoption. A recent survey by Fidelity Institutional Asset Management of nearly 800 US investors found that digital assets are gaining in attractiveness and 80 per cent of respondents found them appealing. A further 36 per cent were already investing in crypto-based assets and 60 per cent have said there is a place for digital assets in their portfolio.

“We estimate that there are around 50 million crypto investors today and we believe that crypto will continue to gain an allocation in most investors’ portfolios, particularly among millennials and the digital native generation Z,” Mr Fetyko concludes.

—

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.

[…] Slovak fintech start-up altFINS secures one million euros in seed round Emerging Europe ” “Cryptocurrency” when:1d” – Google News […]

[…] Original source […]

[…] — to emerging-europe.com […]

[…] securing one million euros in seed funding in July, the Slovak crypto-trading start-up altFINS recently launched a web app to help prospective […]

[…] securing one million euros in seed funding in July, the Slovak crypto-trading start-up altFINS recently launched a web app to help prospective […]

[…] Slovak fintech start-up altFINS secures one million euros in seed round […]