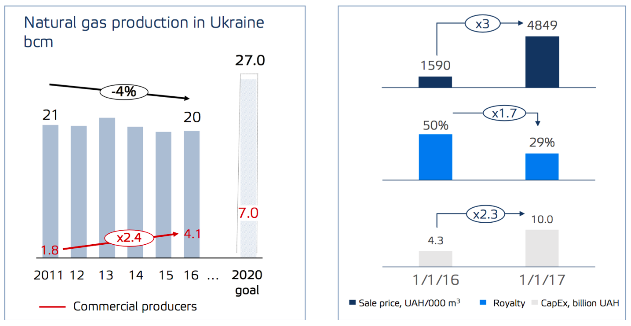

The Concept for Development of Ukraine’s Gas Production Industry by 2020, which was approved by the government in September 2016, predicts that natural gas production should increase to 27 billion cubic metres within four years, compared to the current 20 billion cubic metres. Are these plans feasible?

Let me just lay out a few facts: Ukraine is among Europe’s top-three countries as far as natural gas reserves are concerned. However, the extraction rate is significantly lower than the world average and amounts to a mere two per cent, which indicates a poor technological development of the industry. At the same time, the government assumes that by 2020, investments in the industry will exceed $5.5 billion. Exactly how new private capital and modern technologies will be attracted to the industry remains unclear.

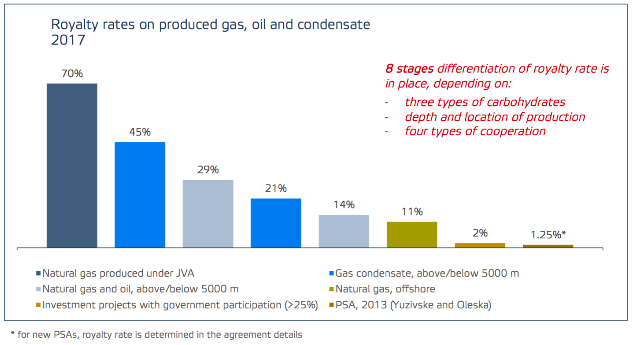

According to Deloitte, the tax burden on natural gas production in Ukraine is more than twice as high as the average European rates (almost 30 per cent as opposed to the average of 12 per cent in the Old Continent). The current multi-rates tax system is absolutely incomprehensible to investors, especially foreign ones, and this leaves a huge gap to be exploited for non-transparent double standards.

In addition, the legislative system is overcrowded and does not have a single decision-making centre. The turnaround time for the whole process, from receiving a permit for subsoil use to the legal setting up of the tract of land under the drilled well, is over around three and half years. It also requires the receipt of numerous permits in the domains of various authorities. The lack of a transparent and competitive environment facilitates corruption. This results in slow dynamics for industry development and a lack of foreign investors.

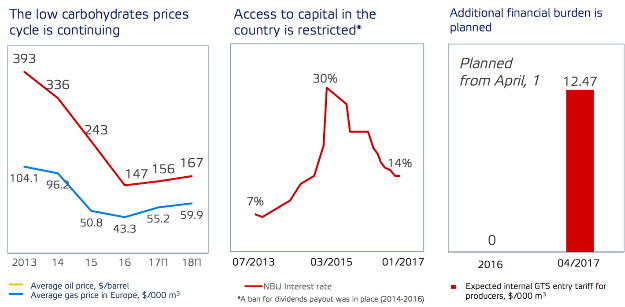

This means that if it maintains the current tax regime, Ukraine will ultimately lose the competition for international investments. At the same time, the main driving force for growth in natural gas production growth should be an increase in investments from internal and external sources, the drilling of new wells on brown- and green-fields and the attraction of modern technologies. The first milestone in the trust-based relationship between Ukraine and the investors, both domestic and international will be the implementation of an encouraging royalty.

In December 2016, the government and the parliament decided to support the natural gas production industry by implementing a motivating flat rate royalty of 12 per cent on natural gas produced from wells, which started drilling after January 1, 2017. However, this arrangement does not include joint venture agreements. The implementation of this initiative will attract over $1 billion of new investments in the industry. Those investments will facilitate a 35 per cent growth of production by 2020, which will result in UAH 14 billion in taxes and approximately16, 000 new jobs.

The year 2016 results show that the gas production in Ukraine has risen by 0.5 per cent and the dynamics of commercial upstream companies have been steadily falling for two years in a row. This is not strange. Both internal and external market conditions are extremely unfavourable for the investor.

So, what is the scenario for Ukraine’s gas production development in 2017? UkrGasVydobuvannya, which is the country’s biggest hope, and for the benefit of which the Government has started the necessary reforms, has declared that it plans to increase its production by 500 million cubic metres – to 15.1 billion cubic metres.

For private upstream companies, low natural gas prices will continue to negatively affect the commercial attractiveness of production. With the current fiscal regime and the existing regulatory obstacles, projects with even a slight risk factor will be discarded. Thus, there is a high probability that the independent gas production sector will enter a period of stagnation, in 2017. Regarding new investors, Ukraine has really big problems with them. It is worth mentioning that not a single international company has entered the upstream industry and, conversely, several of them have left.

What’s next? It is important to urgently develop an effective tool for achieving the goals that are outlined in the government’s Concept Plan. In order to do this, it is necessary that the government make decisive moves aimed at attracting larger investments. It is also important that new foreign upstream companies arrive in the market, which will be capable of attracting capital and the necessary qualifications, combined with advanced technologies.

Without the assistance from the government, the president and the parliament, the noisily communicated plans for implementing the key points of the Concept will remain on the paper.

_______________

The views expressed in this opinion editorial are the author’s own and do not necessarily reflect Emerging Europe’s editorial policy.

Add Comment