European Union countries lost an estimated 140 billion euros in Value-Added Tax (VAT) revenues in 2018, according to a new report released by the European Commission on September 10.

Though still extremely high, the overall VAT Gap – or the difference between expected revenues in EU member states and the revenues actually collected – has improved marginally in recent years. However, figures for 2020 forecast a reversal of this trend, with a potential loss of 164 billion euros in 2020 due to the effects of the coronavirus pandemic on the bloc’s economy.

In nominal terms, the overall EU VAT Gap slightly decreased by almost one billion euros to 140.04 billion euros in 2018, slowing down from a decrease of 2.9 billion euros in 2017. This downward trend was expected to continue for another year, though the coronavirus pandemic is likely to revert the positive trend.

The considerable 2018 VAT Gap however, coupled with forecasts for 2020 highlights once again the need for a comprehensive reform of EU VAT rules to put an end to VAT fraud, and for increased cooperation between member states to promote VAT collection while protecting legitimate businesses.

“These figures show that efforts to shut down opportunities for VAT fraud and evasion have been making gradual progress – but also that much more work is needed,” says European Commissioner for Economy Paolo Gentiloni. “The coronavirus pandemic has drastically altered the EU’s economic outlook and is set to deal a serious blow to VAT revenues too. At this time more than ever, EU countries simply cannot afford such losses. That’s why we need to do more to step up the fight against VAT fraud with renewed determination, while also simplifying procedures and improving cross-border cooperation.”

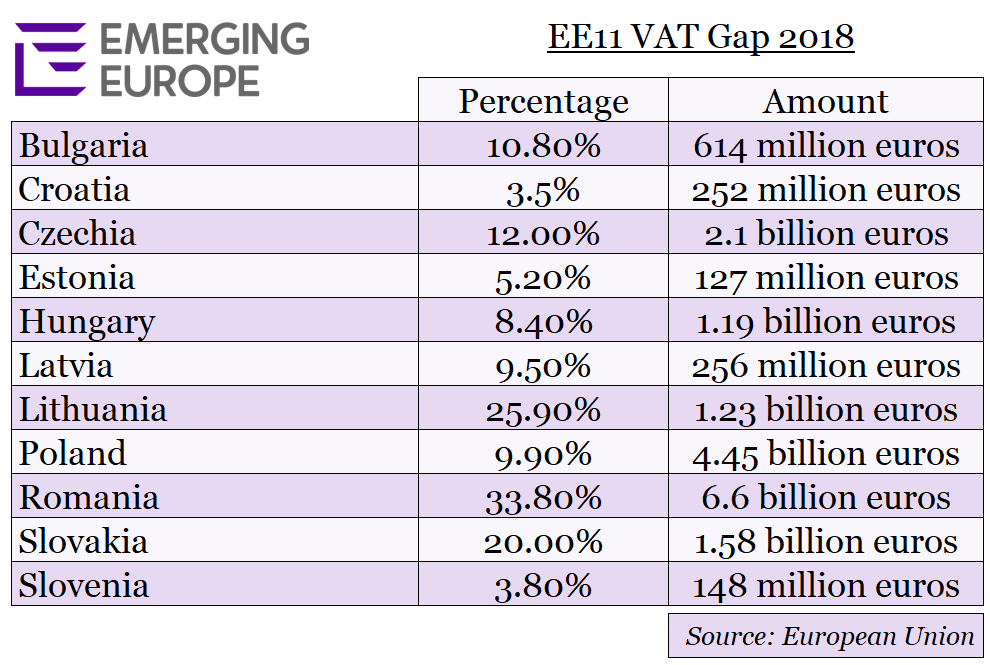

As in 2017, Romania recorded the highest national VAT Gap with 33.8 per cent of VAT revenues going missing in 2018, followed by Greece (30.1 per cent) and Lithuania (25.9 per cent). The smallest gaps were in Sweden (0.7 per cent), Croatia (3.5 per cent), and Finland (3.6 per cent).

Indeed, individual performances by member states vary significantly. Overall, in 2018 half of the EU’s 28 member states recorded a gap above the median of 9.2 per cent, although 21 countries did see decreases compared to 2017, most significantly in Hungary (-5.1 per cent), Latvia (-4.4 per cent), and Poland (-4.3 per cent). The biggest increase was seen in Luxembourg (2.5% per cent), followed by marginal increases in Lithuania (0.8 per cent), and Austria (0.5 per cent).

The annual VAT Gap report measures the effectiveness of VAT enforcement and compliance measures in each Member State. It provides an estimate of revenue loss due to fraud and evasion, tax avoidance, bankruptcies, financial insolvencies as well as miscalculations.

The VAT Gap is relevant for both the EU and member states since VAT makes an important contribution to both the EU and national budgets. The study applies a “top-down” methodology using national accounts data to produce estimations of the VAT Gaps.

—

Unlike many news and information platforms, Emerging Europe is free to read, and always will be. There is no paywall here. We are independent, not affiliated with nor representing any political party or business organisation. We want the very best for emerging Europe, nothing more, nothing less. Your support will help us continue to spread the word about this amazing region.

You can contribute here. Thank you.

[…] Source: emerging-europe.com […]