Tallinn and London-based mobile banking startup has raised 60 million US dollars in Series B capital, which will allow the firm to continue to develop its next generation of mobile banking services and make them accessible to more people around the world.

The new backing comes from a number of leading investors. The Series B round has been led by Kinnevik, a global investor focused on digital businesses, with participation from PayPal, European investor Augmentum Fintech and International Airlines Group for its loyalty and data business Avios Group. Existing investors including Investec’s INVC Fund also participated.

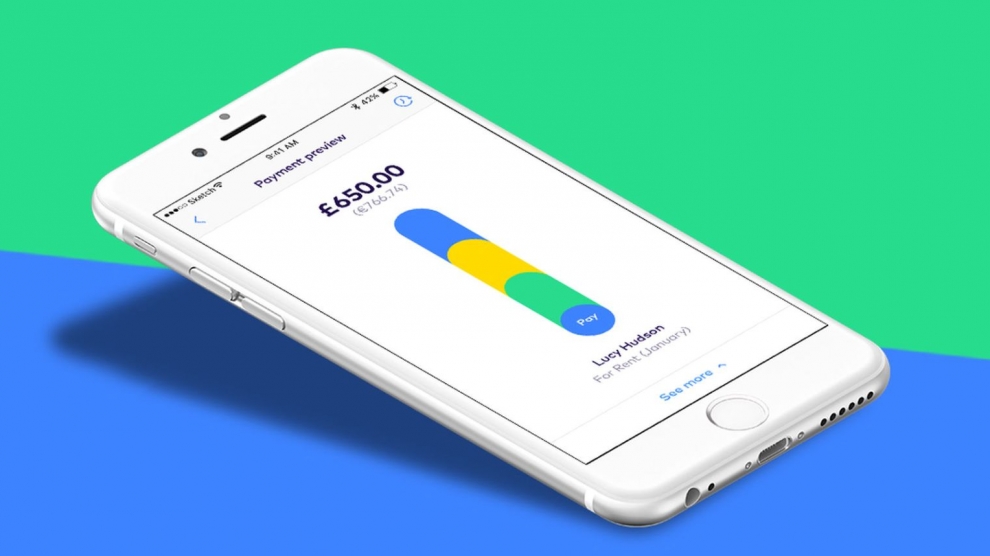

“Because the majority of Monese customers use the banking app as a primary account, including receiving salaries and paying rent, we will be able to leverage this transaction data to help them better access credit and other financial services without solely relying on traditional credit score companies, such as Experian, which don’t have anything like the full picture,” Monese’s Estonian founder Norris Koppel told Techcrunch. Monese crucially allows customers to open UK bank accounts without proof of a UK address: something none of the high street banks can offer.

Monese was launched in 2015 as a basic, bootstrapped product in the UK with the aim of solving a key problem: how to make personal banking easily accessible to all. The service was extended to continental Europe in 2017 and is now available in 20 countries. Monese today services nearly 600,000 users moving over 2.5 billion US dollars a year. The number of new monthly customers has been tripling since the end of 2017.

The company now plans to hire an additional 100 employees across its existing Estonian and UK offices as well as a third new office in Portugal by the end of the year.